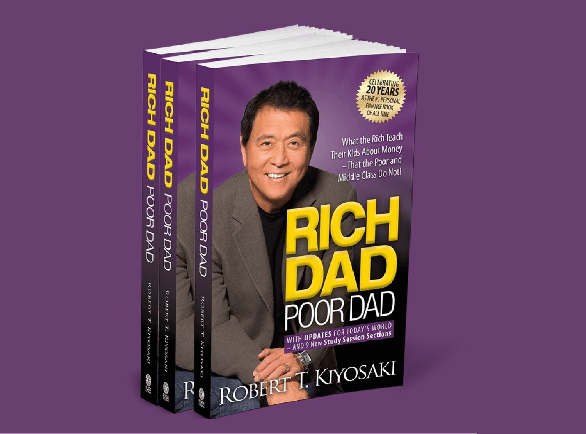

Rich Dad Poor Dad

Category: Books

RS. 200

"Rich Dad Poor Dad" is a persHeonal finance book written by Robert T. Kiyosaki.

* It contrasts the financial philosophies of Kiyosaki's two "dads"— his real father (Poor Dad) and the father of his best friend (Rich Dad).

Go to AmazonHe are Some Key Takeaways From the Book:

Categories

-

Elecronics (3)

-

Home Decor (5)

-

Fashion (2)

-

Health & Beauty (8)

-

Home Appliances (5)

Featured products

Redmi Note 13 pro

View Price

29,999

Refrigerator

View Price

49,000

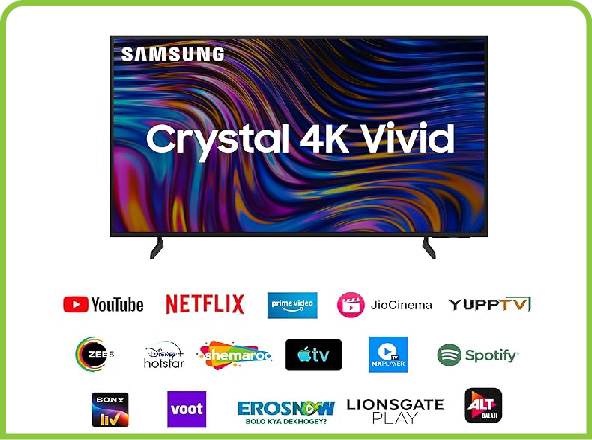

Smart TV

View Price

39,000

Office Chair

View Price

19,999

Earphone

View Price

2,499

canon DLSR

View Price

49,000

The Best Seller Books

Rich Dad Poor Dad (Financial)

Rich Dad Poor Dad is that financial literacy financial success Book

⭐⭐⭐⭐⭐

Get Details

The Atomic Habits (Think big)

People think that when you want to change your life, you need to think big

⭐⭐⭐⭐⭐

Get Details

Think and Grow Rich (Thoughts)

The power of our thoughts, beliefs, extraordinary results.

⭐⭐⭐⭐⭐

Get Details

Power Of Positive Thinkin

Is an incredibly impactful book that packs a wealth of wisdom.

⭐⭐⭐⭐⭐

Get Details

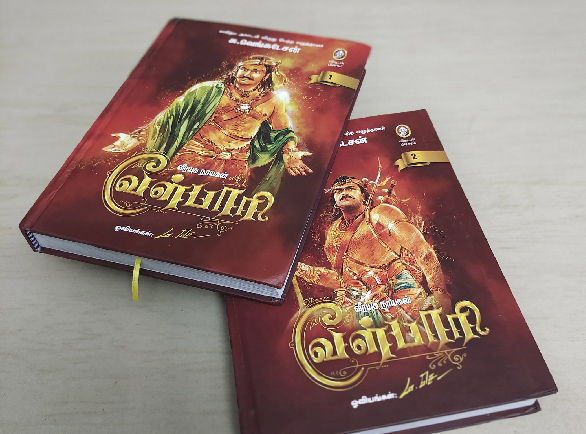

பொன்னியின் செல்வன் (கல்கி)

சரித்திரத்தையும் கற்பனையையும் மிகத் திறமையாகக் படைத்த நூல்.

⭐⭐⭐⭐⭐

Get Details

The Secret (Law of Attraction)

law of attraction power of positive thinking. can help you want

⭐⭐⭐⭐⭐

Get DetailsOur Client Saying!

.

Lorem Ipsum is simply dummy text of the printing Ipsum has been the industry's standard dummy text ever since the 1500s,

Client Name

Profession

Lorem Ipsum is simply dummy text of the printing Ipsum has been the industry's standard dummy text ever since the 1500s,

Client Name

Profession

Lorem Ipsum is simply dummy text of the printing Ipsum has been the industry's standard dummy text ever since the 1500s,

Client Name

Profession